Gilead is Insanely Undervalued

Disclaimer: This post does not constitute financial advice. Author has a long position in Gilead. Do your own due diligence before making an investment.

(This is Part 4 of our Gilead/Roche merger theory. Click here for all the articles.)

Most Gilead investors suspect that something funny is going on.

All of the major indexes are at record highs. Gilead’s competitors are at record highs. Cryptocurrency is at record highs. Companies that don’t even generate revenue are at record highs.

Which makes Gilead’s stock price even more ridiculous, especially relative to its peers.

So just how ridiculous is it? I’ll show you.

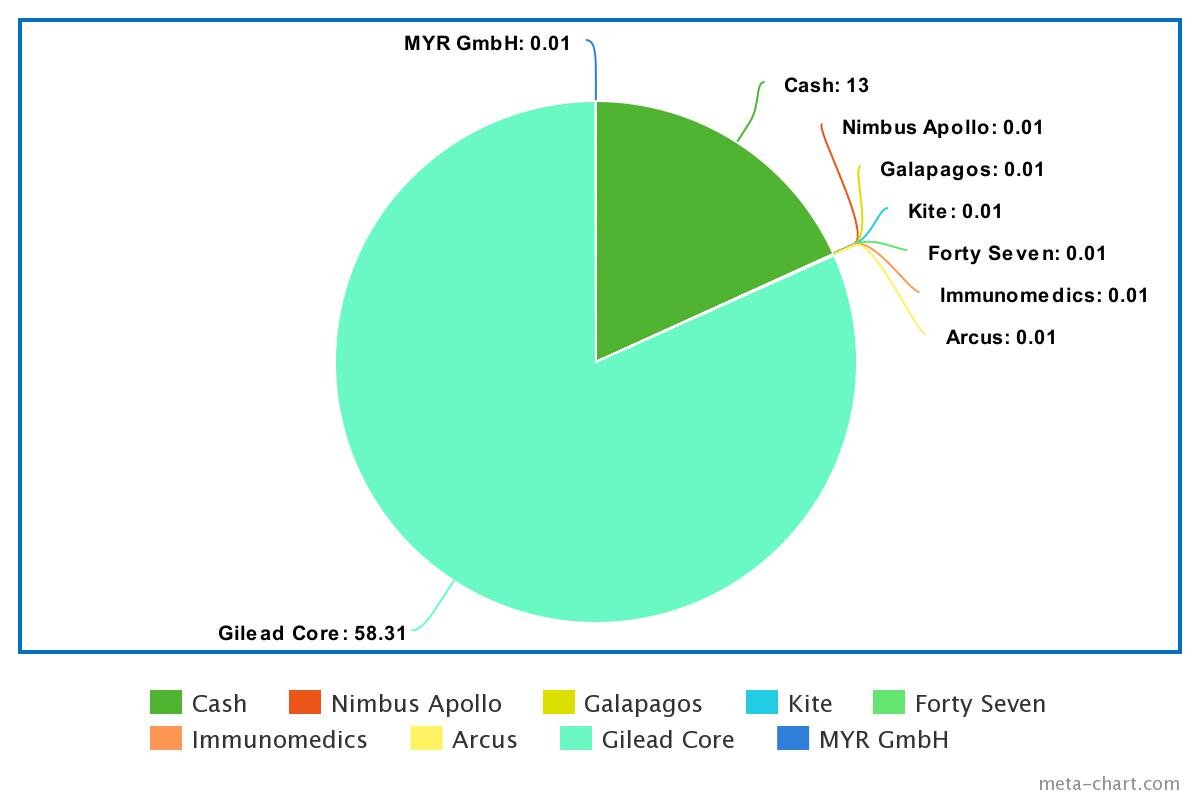

Here is a pie chart of Gilead's current market cap.

Every company/drug that Gilead developed or acquired prior to 2015 I've dumped into the Gilead Core section. In this chart, Gilead Core is only valued at 11.63B, yet brings in about 24B/year. (Crazy, right?)

The other companies (and cash) make up the rest.

Cash is indisputably worth however much they have of it. In this case, roughly 13B. (The books show 11B, but the quarter is almost finished. Gilead probably brought in about 6B, and spent 1.4B on MYR GmbH, and we’ll say some of it goes to taxes, and they lit the rest on fire.)

The number next to the other companies is how much they paid to buy them out or partner with them.

Whatever is left of the market cap is Gilead Core.

Gilead Core is responsible for 98% of Gilead’s earnings.

Most of the drugs they bought are speculative, but Kite, Galapagos, and Immunomedics have already started to pay out. (Galapagos definitely isn't worth 5.1B anymore, but the others might be worth more.)

Especially Immunomedics.

In essence, Gilead paid more for Immunomedics (22B) than the market values Gilead's core holdings (11.6B), which generates 24B/year in revenue now with remdesivir.

Possibly even more next year.

Management has seen unreleased trodelvy data, and might expect Immunomedics to generate more than 10B/year in revenue at some point. Which is definitely possible given that trodelvy appears to be effective in multiple tumors, not just breast cancer.

Prior to acquiring these companies in 2015 and onwards, Gilead was trading at a high of $152.12 (adjusted for inflation and reduced share count because they did a lot of buybacks.) But they did have more revenue back then. 37.79B (adjusted for inflation.)

Gilead’s share count has been dropping, but so has the stock price. (This is abnormal.)

[Source]

In 2015, Gilead didn't have any growth prospects, yet somehow a growth premium was priced in.

Now the company has fantastic growth prospects, but there's no growth premium. If Gilead had the same growth expectations today that it did in 2015 then the share price should be north of 90, possibly closer to 100.

It seems like someone wants to buy Gilead's pipeline, but they don't want to pay a buyout premium. (Greed.)

Buying Gilead out for anything over $91.50 is technically speculative since you can't say for sure that any of those companies will ever earn back the money Gilead spent to acquire them.

Kite, Galapagos, and Immunomedics all have approved drugs and have started to make sales. Trodelvy sales went up 100% in Q2 and 150% in Q3. It’s a blockbuster, and Gilead has more than 30 drugs in their pipeline.

Here’s another chart. It assumes that Gilead overpaid by double on every acquisition since 2015.

As you can see, Gilead Core is now 35B of the market cap. But that’s only about 18 months of revenue at 24B/year. Still ridiculously undervalued. And that’s if you assume they overpaid for everything by double.

Here is even more insanity. This chart assumes that everything Gilead has purchased since 2015 is worthless.

Gilead still generates revenue equal to Gilead Core in only 2.5 years. And that assumes that both Kite and Immunomedics are worthless, which is impossible, since both companies have approved drugs and are already generating money.

Given that Roche’s market cap keeps going up, and Gilead’s keeps going down, it’s only a matter of time before they get sniped.

Imagine this manipulation continues for another year.

Gilead drops another 15% and the broader market goes up 15%.

Roche would have a market cap of 337.5B, and Gilead would have a market cap of 60B.

Roche could buy them out with a tiny equity raise.

Any stock with good revenues and solid growth prospects that doesn’t follow the indexes is probably being manipulated.

Gilead is almost 100% being manipulated for a buyout, and management is probably complicit. (Just like Celgene’s management was in 2018.)

Gilead is mostly owned by institutions (80%).

They don’t care about the little guy.

But I do.

Wall Street is trying to steal your hard-earned money.

Don’t let them.

![[Source]](https://images.squarespace-cdn.com/content/v1/5fa5ec79661ee904d2973ca0/1609207857894-61BTHPCVI7XLJV9YWMSK/gilead+outstanding+shares.jpg)