Growth Stocks are Back on the Menu as Fears of WW3 Fade

Disclaimer: This post does not constitute financial advice. Do your own due diligence before making an investment.

Markets dropped last Friday and continued to slide into Tuesday. But on Wednesday, the China State Council vowed to keep the stock market stable. Essentially saying, “Enough with the destruction of wealth for short-term gains.” Chinese behemoths like Alibaba gapped up more than 20% on Monday.

Since 2014, there has been this great fear that Russia would steamroll across Europe like an unstoppable force. This idea didn’t come from nowhere. When Russia took Crimea, the Ukrainian military was in shambles. Russia’s Little Green Men had no problem infiltrating the island and securing key locations.

It was reported in 2014 that the US told the Ukrainians not to fight. Probably for good reason. Ukraine wasn’t ready to fend off a full-scale Russian invasion. But that was eight years ago. Since then, they’ve been recruiting, training, and importing powerful weapons from other countries. Teachers, lawyers, actors. Everyone has a rifle now is ready to fight off the invaders.

Things are going poorly for Russia, and this was not expected by Wall Street. Make no mistake, Wall Street knew this war was coming.

When did you yourself know that Russia was 100% going to invade Ukraine? Well, like most people, it was probably when Putin announced his “special military operation” and the missiles started flying. But Wall Street knew back in the Fall of 2021.

This is obvious if you look at the charts for almost any growth or risk stock.

Here is a six-month chart of ARKK, Cathie Wood’s flagship growth fund.

Notice how it began to slide last fall as Russian troops began to mass on the border. If you’re invested in growth companies, then your chart probably looks similar.

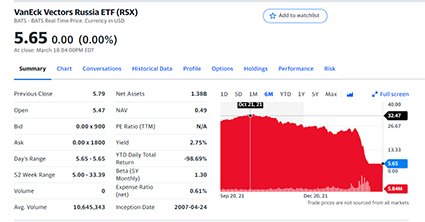

Here is a six-month chart of RSX, an ETF that tracks Russian equities.

It also began to sell off last fall.

And here’s a smoking gun that shows Wall Street knew that war was coming. The six-month chart of oil. As Wall Street was rotating out of growth and innovation, they were buying companies and commodities that would profit from war.

Here’s another one. The six-month chart of Lockheed Martin, an American weapons manufacturer.

So, if you’re wondering why your cool tech stocks and innovative biotech companies have been collapsing for no apparent reason since last October, it’s because Wall Street knew Russia was going to invade Ukraine, and they wanted to capitalize on it.

What they didn’t know was how well the Ukrainian military was going to perform. Russia thought it would be easy as Crimea. In the first 24 hours they even sent paratroopers to capture an airport near Kyiv. (These paratroopers were annihilated.)

Ukraine’s leader, Zelensky, has done a fantastic job at rallying support from western nations. Russia has been cut off from capital markets. Most companies, aside from the usual despicable like Nestlé and Koch Industries, have closed operations in Russia.

The Russian stock market has been shut for weeks. (Although it’s scheduled to re-open on Monday, which should be interesting.)

Putin is running out of cards to play. It seems the Russian bear is nothing more than an old wolf with rabies. People were worried about Russia steamrolling into Poland, but at this point that’s frankly laughable. Russia was said to have the second greatest army in the world, but it seems they only have the second greatest army in Ukraine.

Russian capitulation is inevitable. Troop morale is near absolute zero. They aren’t fighting for anything of real value. Most people are inherently good. We want to build things and contribute to society. We don’t want to murder innocent people and destroy their homes.

The comparison to Germany in 1939 is not a good one.

Hitler was a great public speaker, Putin is not.

Hitler controlled the media told believable lies about why Germany should go to war, Putin has not.

The German people spent the years between 1919 and 1939 living in poverty. Russians have spent the last 20 years enjoying technology and innovation.

While the destruction that Russian forces are currently inflicting on cities like Mariupol is similar to WW2, the rest is not.

There were no drones in WW2. There were no javelin or stinger missiles. Conventional forces are not as useful as they used to be. With a few hours of training, a grocery clerk can destroy a tank. This is a good thing. It’s like in the board game Risk where the defender wins ties. Except now with modern technology the defender also wins ties +1.

Belarus hasn’t sent in troops. Neither has China. China hasn’t even agreed to supply Russia with weapons.

Without rambling any further, all of this is to say that WW3 has been significantly de-risked. And you can see it in the charts. When it became obvious that Russia wasn’t going to capture Kyiv in a matter of days, oil began to sell off. So did defense stocks.

Wall Street was caught with their pants down. It took them months to rotate out of growth stocks and into war stocks. And now, unless there is massive escalation by the Russians, there will be another rotation.

If Putin dies in a coup, or agrees to peace terms with Ukraine, then the risk of WW3 will be eliminated. This will result in weeks of green candles for growth and risk assets. And it seems like it’s already started.

ARKK is up 18% in the last five days.

XBI, which has been getting slaughtered for more than a year, is up 9% in the last five days.

MTNB (my favorite small-cap biotech) went up 19% on Friday.

Putin does have some options left. He’s famous for false flags and bombing his own people. But people expect this of him now. Most Belarussians hate their leader as much as Putin. Even if Putin blows up some apartment buildings in Minsk, nobody with a brain will believe it was the Ukrainians.

Note: it was reported this morning that 11 Belarusian diplomats (including the ambassador) have left Ukraine. This is worth keeping an eye on but hasn’t yet materialized into anything. While I think it’s probable that Putin will try to stage a false flag in Belarus to try bring them into the war, I don’t think it will be as easy as he thinks.

His most powerful card is extortion with tactical nukes. Although it’s unknown what the Russian nuclear chain of command is. Can Putin himself launch the nukes, or can someone disobey his illegal orders and remove him from command?

Hopefully it’s the latter.

Growth and risk stocks are still down about 50% from last Fall. Which means unless there is a massive change to the status quo in Ukraine, they could rally by 100% in the coming months. The jump will happen faster than the drop, so don’t get tricked into selling early.

Just because your stock jumped 20% in a day doesn’t mean it’s a good reason to sell. Hold on to your gems and cross your fingers for peace.

Markets will be frothy as Putin flops around like a piranha at the bottom of a canoe.

There might be further buying opportunities for growth stocks before we start another bull run. Watch your stops and don’t go too deep on margin.

Thanks for reading and don’t forget to follow us on Twitter.

If you’d like to support Ukraine, grab yourself some St. Javelin merch. The t-shirts look amazing.