Paramount’s Proposed Layoffs Signal Preparations for a Buyout

Disclaimer: This article is for informational purposes only and does not constitute financial advice. Please consult a financial advisor before making any investment decisions.

In the grand cinema of the stock market, where narratives of triumph and turnaround play out with breath-taking suspense, a new story is unfolding with Paramount Global (NYSE: PARA) at the center stage. As the curtains rise, we see a company steeped in history, ready to embrace a transformative future that's sending ripples of excitement across Wall Street. Let's dive into why Paramount Global might be the investment blockbuster of the year.

A Legacy Poised for Premium Buyout

Paramount Global, a beacon of Hollywood's golden age, is now in a pivotal act of its storied legacy. With Shari Redstone, the maestro behind the scenes, reportedly orchestrating a strategic sale, the buzz is undeniable: Paramount is primed for a premium buyout. The recent whispers of layoffs are not a sign of distress but a masterstroke of pre-sale housekeeping. It's a savvy move ensuring the company strides onto the auction block lean and primed for a new era, all while securing a harmonious start with potential new owners.

The Skydance Synergy

Enter Skydance, the powerhouse behind recent blockbusters, now a leading suitor for Paramount's treasure trove of assets. This isn't just a deal; it's a potential merger of cinematic titans. Skydance's appetite for Paramount's storied studio and lucrative IPs is the talk of Tinseltown. With the Ellison family's deep pockets and a valuation soaring to the heavens at $4 billion, Skydance is more than just interested—they're ready.

Buffett’s Blessing

When Warren Buffett, the Oracle of Omaha, lays down a hefty bet on Paramount, taking a $2.1 billion stake, you know there's more to the story than meets the eye. Buffett's Midas touch could be hinting at an undervalued gem, a narrative that's now gaining plot twists with stock prices surging as much as 39% amidst buyout whispers.

The Golden Parachute Prelude

Paramount's board, with a nod to strategic foresight, has approved golden parachutes for its top brass. This move, often a harbinger of M&A activity, suggests the wheels for a transformative deal are not just in motion—they're accelerating.

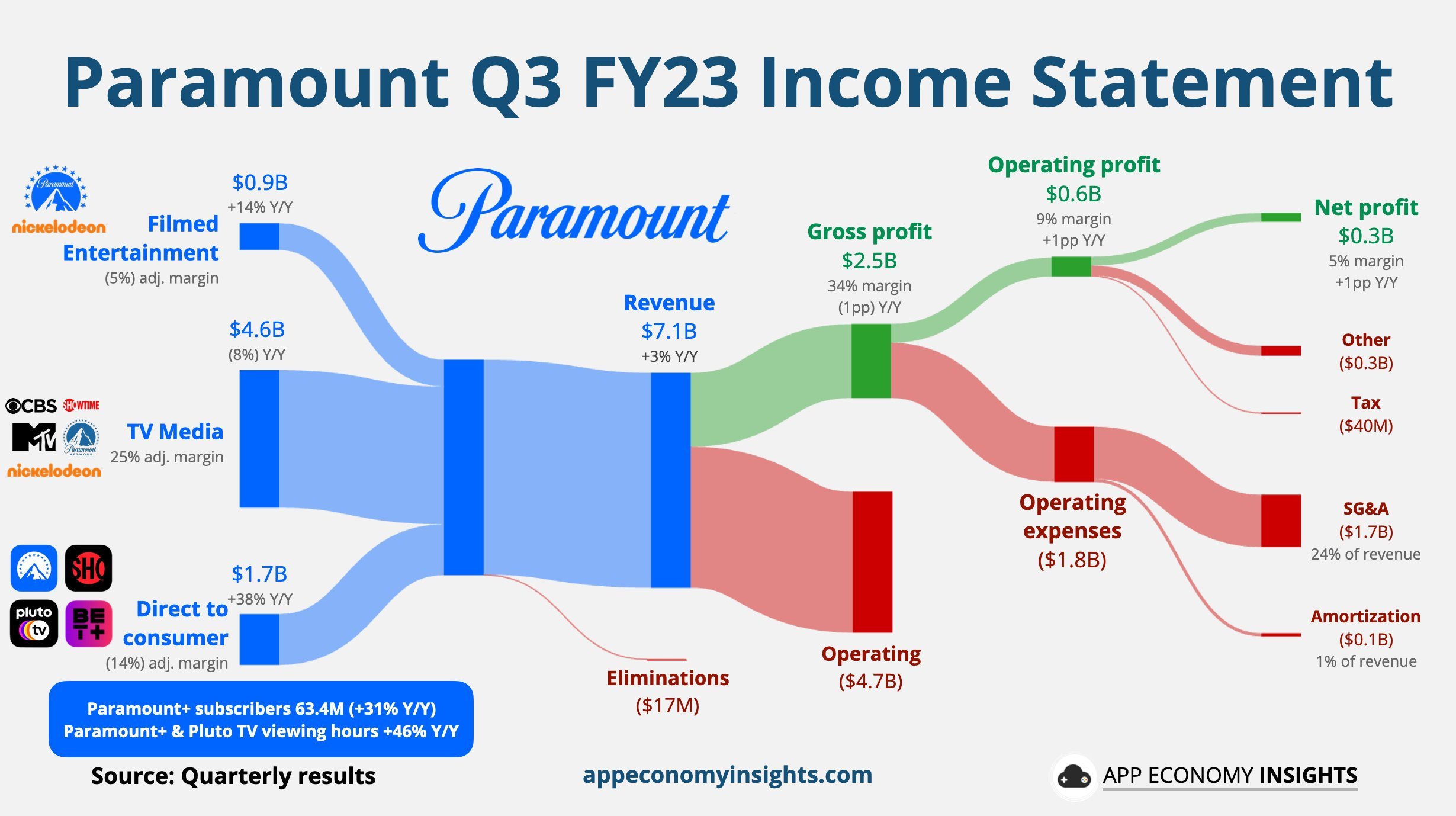

Paramount's financials are a fortress waiting for the right banner. With a revenue stream flowing at $7.1 billion and direct-to-consumer segments surging by 38%, Paramount is not just surviving; it's thriving. The streaming platform Paramount+ has bolstered its subscriber base to a staggering 63.4 million, a 31% year-over-year growth. And let's not overlook the 46% surge in viewing hours, a testament to content that captivates.

The Streaming Strategy

Paramount+, amid a fiercely competitive streaming landscape, is not just holding its ground; it's poised for an alliance that could redefine the streaming wars. A rumored bundle with Apple could be the strategic masterstroke, offering Paramount+ as part of a discounted powerhouse package.

The market is abuzz with talk of a breakup, but here's the twist—it's a good thing. Divesting non-core assets to streamline the operation is like a scriptwriter refining the plot for maximum impact. And with potential sales of assets like Showtime and BET Media Group, Paramount is trimming the fat, readying itself for a lean, mean, content-producing machine.

Should Skydance and RedBird Capital take the helm, Paramount could see its studios fused with Skydance's cutting-edge production, while streamlining operations like Paramount+ could be in store. This is not just change; it's evolution.

Paramount's content is its crown jewel. With a library that's the envy of the industry and potential deals that could see its value double, Paramount's narrative is far from over. It's just getting to the good part.

The Layoff Prologue

The talk of layoffs, while unsettling, is a strategic step towards a leaner, more agile Paramount. This is not the story of decline but of preparing for a rebirth under new visionaries who see the untapped potential waiting to be unleashed.

For investors, Paramount's tale is reaching a crescendo. With a company that's reshaping itself for the future, the stage is set for a dramatic upward trajectory. It's a moment brimming with potential, a chance to be part of a historic turnaround that could see Paramount reclaim its throne in the entertainment kingdom.

As the spotlight intensifies on Paramount Global, the narrative is clear: this is a company at the cusp of a renaissance, a buyout tale that's more than mere speculation—it's a strategic evolution. And for those with the foresight to see its unfolding potential, the next act could be nothing short of legendary.

Follow us on X (formerly Twitter) for exclusive content, news, giveaways, and interactive polls that shape our next articles.