Gilead and the NIH Appear to be Holding Back Data on LNC Remdesivir

Here are some facts on LNC oral remdesivir, a possible silver bullet in the fight against Covid-19.

1. During their Q2 2021 results press release Matinas said the in-vivo study of the LNC remdesivir was scheduled to start in Q3 2021. [Source]

2. On November 2nd, in the Q3 2021 results press release, Matinas said the study had commenced at the University of North Carolina. [Source] (Assuming it did start in Q3, this is a window of only 33 days. October 1st to November 2nd)

3. The primary endpoint for Gilead’s early-use outpatient IV remdesivir study was a reduction in risk for the composite primary endpoint of COVID-19 related hospitalization or all-cause death by Day 28. [Source]

4. On November 17th, Gilead’s stock price began to rocket upwards for no apparent reason.

5. On November 23rd, Matinas participated in a fireside chat at the B. Riley Fall 2021 Growth Biotech Best Ideas Series. In regards to the data on the LNC in vivo remdesivir study, the CEO of Matinas said: “That’s a little bit of a unique situation where we have some big brothers and big sisters at the NIH and Gilead that like to review everything and decide what we can announce but our expectation is if lines up with where the in vitro data was that it would be hard for them to sort of uh, not shout it from the rooftops.” [Source] (57:22)

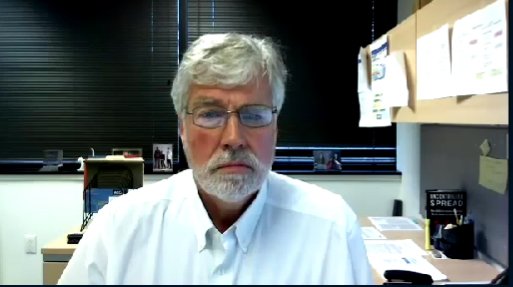

Take a look at the face of James Ferguson, the Chief Medical Officer of Matinas when the CEO said that bit about the NIH and Gilead reviewing the data.

For reference, this is what his face looked like for the rest of the conference call:

So…

If the in vivo study began on or before October 15th, the NIH, Gilead, and Matinas know whether the primary endpoint was achieved. This a genetically-modified mouse study. Realistically speaking, they would know whether it works or not by day 15. Day 28 just gives them a complete picture. There would be sick mice, dead mice, and mice that were discharged from the lab because LNC oral remdesivir reduced or eliminate their symptoms.

Here is some speculation:

1. LNC remdesivir works. The in vivo data was similar to or better than the in vitro study. Gilead knows this. The NIH knows this. Matinas knows this, especially James Ferguson who needs to work on his poker face.

2. Gilead is being extremely careful in how they present this data given the evolving landscape of Covid-19 treatments and the previous shunning of remdesivir by the WHO.

3. It’s possible that LNC oral remdesivir works too well and they’re scrambling with how to deal with supply and distribution issues. Remember the movie Contagion? The doctor that was kidnapped and ransomed for vaccines? That could happen in the real world except instead of vaccine shipments being hijacked it’s LNC oral remdesivir. Especially if Covid-19 mutates into an Omega variant.

Given how Matinas’ LNC technology was able to eliminate the toxicity and increase the efficacy of amphotericin B, and given how well LNC remdesivir performed in the in vitro study, it seems likely LNC remdesivir will replace classic remdesivir. (Classic remdesivir has kidney/liver issues which LNC tech might eliminate.)

Pfizer’s market cap jumped by 25 billion when the results of their Covid-19 antiviral were released. Merck’s stock jumped by 11 billion.

Matinas Biopharma only has a market cap of 227 million. The upside potential on this stock is ridiculous. It’s possible that Matinas is only a few press releases away from going up fifty to a hundred times. If you can show me an investment with better risk/reward profile I’d love to see it.

Good luck with your investing and don’t forget to follow us on Twitter.

(Disclaimer: This post does not constitute financial advice.)