12 Signs Your Stock is Targeted for Buyout Theft

Are you frustrated with the performance of your stock? Has the price been dropping for months for no reason at all? It might be intentional. Wall Street might be trying to steal your company for cheap.

Buyout theft is when a company is bought out or taken private for less than its fair value. Usually with no real merger premium. Buyout theft is when Wall Street destroys a stock price and then buys out the company for peanuts.

It happened to GasLog back in February, and it happened to Casper on November 15th, 2021. Both these companies share similar traits which will we explore below.

Buyout theft should be illegal because small investors get screwed. In the case of Casper, the stock went public in February 2020 at $12/share and closed the first day of trading at $14.50. If an ordinary person invested their hard-earned cash in the company, they would have gotten ruined. In the last year the stock had a high of $12 and a low of $3.18.

The CEO gets to keep their job. Institutional investors might keep shares in the newly private company. But a small investor? Joe Sixpack or Jill Yogabutt? They hand over their shares at gunpoint. The winners in buyout theft are the acquiring company, and anyone who bought at the lows. Everyone else gets fleeced.

Here are 12 signs your company is being targeted for buyout theft

1. Stock Price has Been Declining for Months

Wall Street doesn’t want to steal good companies for cheap. They want to steal great companies for rock-bottom prices. They’re not happy making millions. They want billions. But to get those billions, they have to steal from you, although buyout theft is technically legal.

If your stock price has been declining for months for seemingly no reason at all, this is a red flag for buyout theft. Wall Street knows you check your stocks every day. Maybe even every hour. They know what the psychological effects are of your stock always being red.

They are trying to frustrate you into capitulation. You watch the markets. You see junk stocks jumping 20% in a day and think, “Why not my stock? It’s a good company.” Some people get depressed and sell. Institutions gobble up the shares and this makes the buyout theft easier. More shares equals more yes votes on a potential buyout.

2. Down 50% or more from recent highs.

Wall Street can see your stop loss orders. They often do stop-loss raids to trigger your market sell order. Most people can’t stomach a 50% loss. Or maybe it’s higher. In Casper’s case, they nuked the stock from $12 to $3. That’s a drop of 75%. Only the die-hard true believers were still holding after a beating like that.

The more your stock is down, the more likely someone is to try and steal it. Imagine walking around a neighborhood and the price of each home was posted on the garage. Most homes in the area are $500,000. One home is priced at $400,000 but you can’t figure out why. Yeah, maybe it needs some paint and landscaping, but that doesn’t justify a 20% haircut.

A few weeks pass and you walk by the house again. Now it’s at $300,000. You knock on the door and ask to buy the house. The owner says it’s not for sale at this price.

Two months pass and now the price on the house is $125,000. You think this is insane but everyone else just shrugs and says, “Must be something wrong with it.”

Again, you ask the owner to sell, but he refuses. The next day you wake up and read in the news that BlackRock has bought the house for $250,000. The owner was quoted as saying, “It was frustrating watching my house decline in value and I was afraid if I didn’t accept this price, my home’s value would fall further. Also, BlackRock already owned 51% of the house, so I didn’t really have any choice in the matter.”

If that scenario sounds ridiculous, then you’re starting to realize what a problem buyout theft is. Buyout theft is made possible because many so-called “public companies” are actually controlled by a few large corporations and their subsidiaries.

3. High institutional ownership.

Who owns your company? Visit Yahoo Finance and click on holders. This will show you what percentage of outstanding shares are owned by insiders and institutions. The rest of the stock is owned by small investors.

If someone (or a group of people) owns more than 50% of a company, they can pretty much do anything they want. All major decisions in a company are voted on at shareholder meetings. If the buyout thieves control more than half the company, it doesn’t matter how the small investor votes.

Here’s what Casper’s holders look like:

Insiders and institutions own 72.76%. If you own Casper stock, it’s completely irrelevant how you feel about the company going private. Your votes are meaningless.

So, if you think your company is being targeted for buyout theft, check the holders. If insiders and big funds own more than 50% then a merger could be on the table.

4. Paid bashers claiming bankruptcy.

Banks and hedge funds use sock puppet accounts to clutter message boards. They spread fear and misinformation for two reasons.

1. To get you to sell.

2. To get new investors not to buy.

Short sellers and buyout thieves spreading lies about a company isn’t a new thing. It’s been going on since the dawn of Wall Street. Learn how to spot paid bashers and stock manipulators here.

Here are some posts I dug up from before the Casper buyout was announced.

Posts like this convince naïve investors that yes, selling is a good idea.

FUD: Fear, uncertainty, doubt.

“The sky is falling!”

Bankruptcy + offering fear.

This account seems to have been created solely for the purpose of manipulating Casper. Notice it was created July 14th, 2021. Several months before the buyout.

Here’s what the CEO said about the deal. [Source]

They had been talking for months about a deal. The Hellokittygrinder StockTwits account was created on July 14th. From July to November the stock price of Casper slid from $8.38 to $3.18.

While there is no definitive proof, I believe one of the companies or investment banks involved in taking Casper private employed people to post negative comments on Casper message boards. They did this to manipulate sentiment and make people think the company was going bankrupt. This allowed them and their friends to accumulate cheap shares which they used to vote yes on taking the company private. Management appears to have violated their fiduciary responsibility to small investors by selling the company for 20% less than where it was trading in July.

You can find more posts like the ones above on StockTwits if you scroll back through the Casper board.

5. Company needs cash but isn’t doing any capital raises.

Companies targeted for buyout theft usually aren’t rolling in cash. Business isn’t great but it’s not a total disaster. There’s probably some revenue, it just isn’t enough to fund operations past a certain date. Maybe six to 12 months out. This is the CFO’s problem. One of their jobs is to make sure the company doesn’t run out of cash.

When dealing with a shrinking bank account, businesses have several options to raise capital. They could issue new shares (public or private offering), they could raise money by issuing debt, or they could recommend massively cutting expenses. Sometimes it’s a combination of all three.

Offerings are good and bad. Existing shareholders get wrecked a bit. Offerings are usually below the current market price. So, the stock price goes down. But the company receives a boatload of cash. If they use this cash to fuel revenue growth, the stock price might recover in a few quarters.

Debt is similar. The company borrows money which adds a liability to the balance sheet. Cash is added to the asset column which offsets the liability. Shareholder’s equity remains unchanged. Until the next update. Because now each month the company is spending the cash and paying interest on the debt. So, you can expect shareholder equity to decrease over the coming months. This is fine assuming the company increases revenue or returns to profitability.

Cutting expenses can be either a good or bad sign. Marketing goes first, then jobs, then the company abandons their leases and sells off equipment/infrastructure. Cutting expenses makes it harder to return to growth. (How do you increase sales if you’re laying off your salesforce?) Cutting expenses is a good sign if a buyout is in the works, but a bad sign if it’s not.

So, if the CFO can fix a cashflow problem, but why aren’t they doing anything about it? The company you invested in is running out of cash. Revenue isn’t expected to cover this shortfall until way past the date the bank account runs dry.

This is a major sign that buyout theft is imminent. The company isn’t raising cash because they know they don’t need it. Whoever plans to buyout the company or take them private has lots of cash. Enough to cover expenses for several years.

If Casper needed money to fuel growth, why didn’t they just do an at-the-money offering when the stock was trading at $8 or $9? They could have raised $50 million dollars, and the stock might not have dropped below $6.90.

6. Management stops defending the stock price.

A company’s stock price is an asset. The higher it is the better. A high stock price makes issuing capital easier. It makes issuing debt cheaper. It’s prestigious and attracts attention.

“Widget Corp Hits 52-Week-High.”

“Widget Corp Becomes World’s First Quadrillion-Dollar Company.”

People like investing in hot stocks. Stocks with hype. Companies that look like they’re going to the Moon instead of bankrupt.

So, what happens when short sellers start chipping away the stock price? What if someone publishes a series of negative articles? What if the stock drops 10% for no reason?

Well, management has tools to combat this. They can get on social media. They can issue press releases talking about upcoming milestones. Current projects. Updates. Guidance. They can bring the hype back to a depressed stock.

So why aren’t they? Why hasn’t management said anything even remotely interesting in the past few months? Why didn’t they take any (or many) questions on the last conference call? Why are they on vacation while the stock price is plummeting? It might be because management just doesn’t care anymore. A buyout price has been reached and their golden parachute has been secured.

Buyouts, mergers, and privatization deals take months to hammer out. Companies aren’t approached for a buyout on Saturday and then drop the PR on Monday. It takes a long time to get it done. Months of inaction or laziness by management can be a sign that behind scenes they’re working to sell the company or have already cut a deal.

7. Current CEO didn’t start the company.

If a company has been struggling, you’ll sometimes see the founders make an exit. They have enough to retire and don’t want to hang around and watch their brainchild burn to the ground. People that start a company are emotionally invested in it. New hires are not. This applies to everyone, especially the CEO.

Chief executive officers are romanticized in the media and popular culture. People wants to be one, date one, marry one, etc. But it’s just a job. You can apply for it just like any other gig. Yes, most people don’t qualify, but, at the end of the day, to a new CEOs trying to fix a struggling company, it’s just a paycheck.

Despite what they say in the media, a new CEO probably cares about their job just as much as you do about yours. If you were offered three times your current salary to sell the company to someone else, would you do it? Most people would. A job is job. You can always find a new one. And now your resume shows you negotiated the successful buyout of a struggling company.

“I doubled the stock price from $3 to $6. I’m a hero.” – Chad Snakeoil, new CEO

“The share price was $12 less than a year ago…” – Jimmy Diamondhands, long-term shareholder who just got ruined due to buyout theft

8. Phantom premium reaches 100%.

When a company is bought out or taken private, there is often a premium given to the stock price. This premium might be low or high. When Gilead bought Immunomedics they paid a 108% premium. This was a real premium because the stock was trading near recent highs.

When Casper was taken private, shareholders got an 88% premium. This is phantom premium. It’s fake. It’s bullshit. It’s a scam.

Casper, just like GasLog, had recent share price highs that were far above the buyout price. Ordinary shareholders got fleeced, and the institutions got away with financial theft.

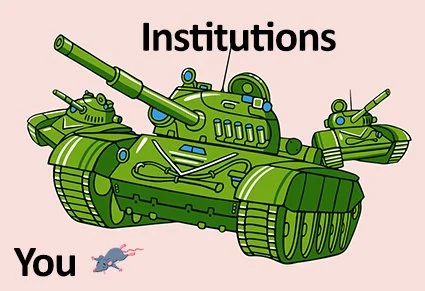

Phantom premium is the boost a stock gets during a buyout that is a snapback to its fair value. It’s not a real premium. If there’s a lot of phantom premium on the table, then a buyout is more likely. This is because the acquirer has less risk. Buying a company for $200M is less risky than buying it for $400M, especially if the fair value is $400M. It’s legalized theft. Rich corporations profit and small investors get run over by a tank.

There must be enough phantom premium during buyout theft so the headlines aren’t, “Widget Corp Going Private for 2% Premium.”

Or in the case of Casper: “Casper Going Private for -20% Premium.”

That would never fly. People would be furious. There would be shareholder riots. Congressional hearings. Articles in the Wall Street Journal on how the small investor is getting robbed. But an 88% buyout premium? That seems legit. Phantom premium exists as evidence that the company isn’t being stolen. But it is.

9. Unusual options activity

Even though insider trading is illegal, it happens every day on Wall Street. Before a merger/buyout there are always suspicious options trades. Banks, traders, lawyers, management from both companies, maybe even the receptionist. Lots of people know about the buyout before it happens. Some of them act on it by giving this information to people who trade options. Or maybe even making trades themselves.

Here’s what to look for:

1. Calls being purchased near the ask.

2. Puts being sold at the bid.

Calls payoff bigtime if a company is bought out. Buying at or near the ask is a sign of confidence. You can’t buy lots of calls in a hurry at the bid price. There’s nobody to sell them to you. Someone who buys a lot of calls at the ask price is hurrying to secure a position.

On the other side, puts will expire worthless if a stock is bought out. So sometimes you’ll see big put blocks being sold near the bid. This is free money for the seller if they know a buyout is coming.

Don’t just watch for options expiring in the near future. People who do insider trading are sneaky. They’ll try to hide it by hitting options that are several months or years away from expiring This crooks earn less money, but it also reduces the chance they’ll end up in jail.

“I didn’t know a buyout was coming. I bought options that expire in a year. If I was insider trading I would have bought options that expire next week.” – Brock Shitheel, mid-level executive at an M&A law firm.

Focus on the number of options being purchased/sold relative to the outstanding interest. The larger the spread the better.

For example: If the outstanding interest in $100 April calls is 2,305, and the daily volume is 14,000, that’s a red flag. Note these two numbers and check back tomorrow. See what the new outstanding interest is. If it’s more than 16,000 you’re probably on to something.

10. Pinned for Months

Does your chart look like someone is sitting on the stock price? Does your stock not go up for any reason, no matter what the broader market is doing? It might be pinned.

Hedge funds and institutions can control the price of stocks. They have billions, if not trillions of dollars of firepower. When looking at stocks with market caps under five billion, you must be aware that Wall Street can move the stock up and down at will. They can open and close a stock at any price.

This becomes obvious if you watch the one-minute chart on a stock. Stocks that are being manipulated might jump 5% on 100k volume, but then see this 5% chipped away with a series of small trades. Stocks can swing up and down on very little volume.

A stock that is being targeted for buyout theft must be kept pinned so the phantom premium remains intact. Institutions can’t let the stock climb because it would destroy the narrative that the company is going out of business and needs someone to swoop in and save them.

11. The company would complement someone else’s business.

Try to think a few years into the future. Your company has been bought out and merged with someone. They’re now a division of a conglomerate. Who is it? Which larger company would love to have your smaller company as a subsidiary?

Are there lots of possibilities? The more the better. If you can think of another company that would be a good fit, it’s likely they’ve thought of this as well. And they might be making a move to buy you out.

12. Big jump after weeks or months of red.

If your stock has been pinned for months, then why did it jump on Thursday by 6% for no reason? Why did it jump again on Friday by 7% for no reason?

No obvious reason anyway. The reality is a buyout or merger deal might have leaked. Details might be announced over the weekend or Monday morning before the markets open.

If you’re long at $12 and the stock price is $4 then you’re exposed to buyout theft . In this situation, if I thought my stock was being targeted for buyout theft, and it jumped big on a Friday for no reason after months of being pinned, I would hedge against a buyout.

Hedging against buyout theft is as easy as buying more stock or buying short-term call options. If there’s no buyout announced by Monday, you can always close the new position.

Even if your stock isn’t bought out (or taken private) buyout theft could still occur. Someone might take a major stake in the company when the stock price craters. Like when Morgan Stanley announced a near 10% stake in Waitr Holdings, causing the stock to run up 250% in the next 10 days.

What can you do if you think your company is being targeted for buyout theft?

1. Hedge against an imminent buyout with call options.

2. Hedge against months of declines with put options.

3. Share this article and make other investors aware of buyout theft.

If a company goes public, it should be banned from going private for at least five years. Otherwise, the future of IPOs will be more buyout theft. Stock prices will be pumped to the Moon and then massacred with retail left holding the bag. Then a buyout or privatization.

It’s wrong and it should be a crime.

Good luck with your investing and don’t forget to follow us on Twitter!

(Disclaimer: This post does not constitute financial advice.)